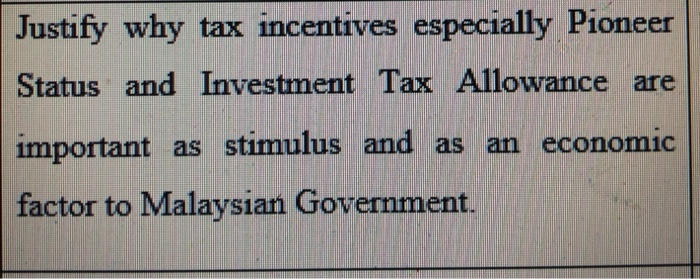

pioneer status and investment tax allowance

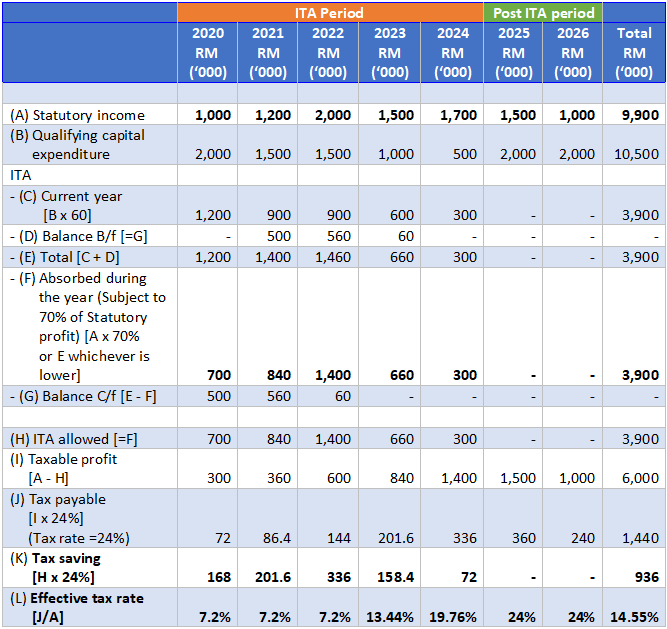

ITA is an incentive granted based on the capital expenditure incurred on industrial buildings plant and machinery used for the purpose of the promoted activities or the production of the promoted products. Similarly the marketing manager also helps and assists the top management in framing the pricing policies and strategies.

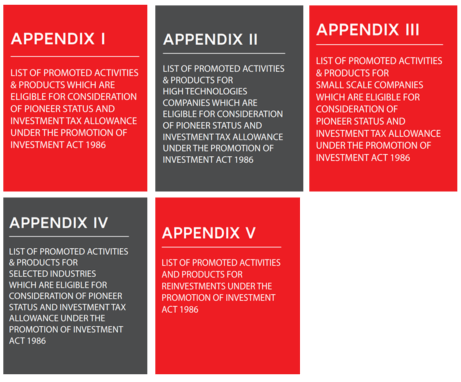

Promoted Activities Mida Malaysian Investment Development Authority

Waiver of interest in full - Failure to remit advance tax - seeking the immediate release of the sum held in fixed deposits by the Official Assignee towards the interest demand of the Income Tax Department - direct the Income Tax Department to refund the excess tax remittance by Respondent to the Petitioner without further delay - Interest us 234A 234B and 234C for.

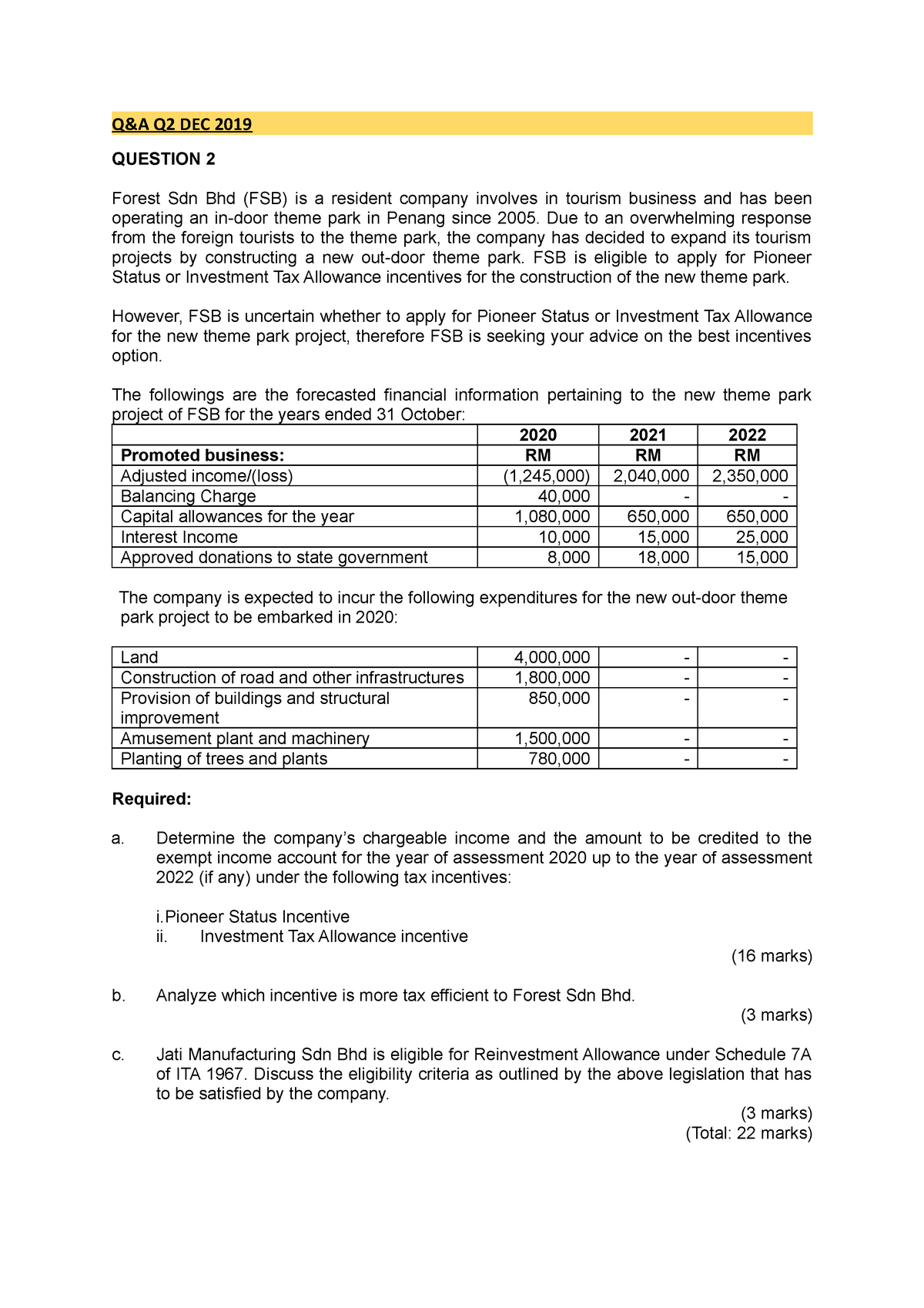

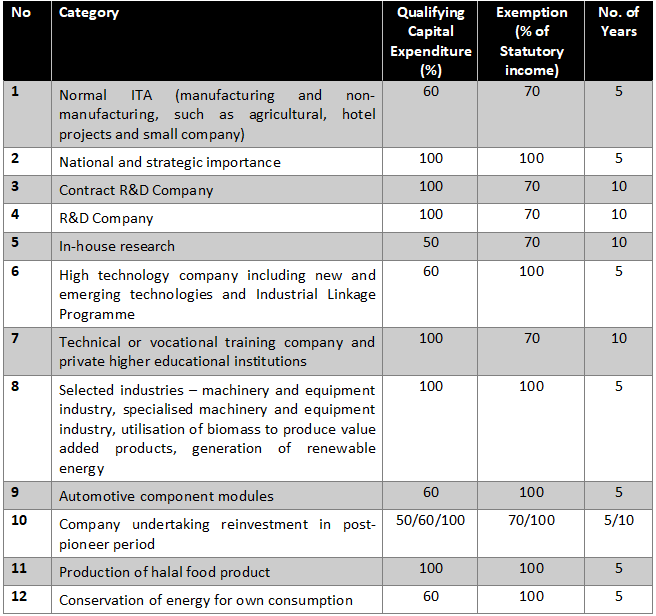

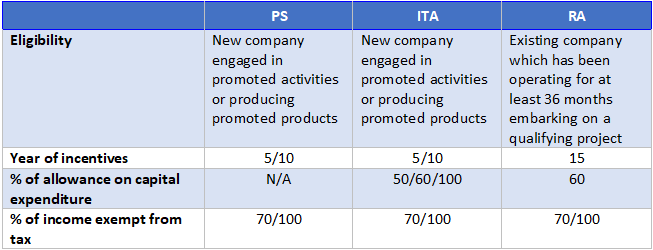

. This incentive is generally given for a period. From the date of approval up to a period of 5 years 60 of the QCE or Qualifying Capital Expenditure should be offset against 70 of the statutory income for every year up to hen YA will. Tax will be exempted on 70 of the income for a period of 5 years from the date of start of production.

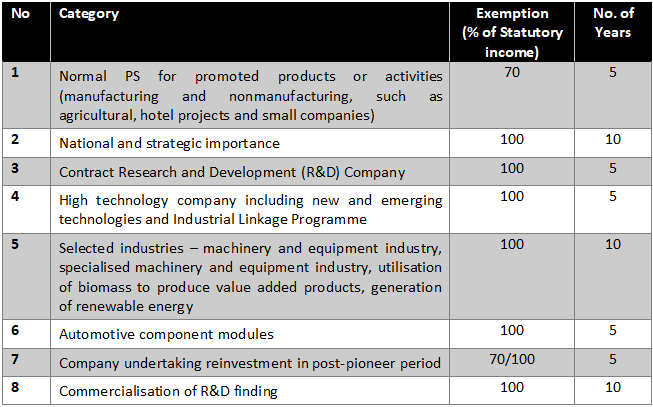

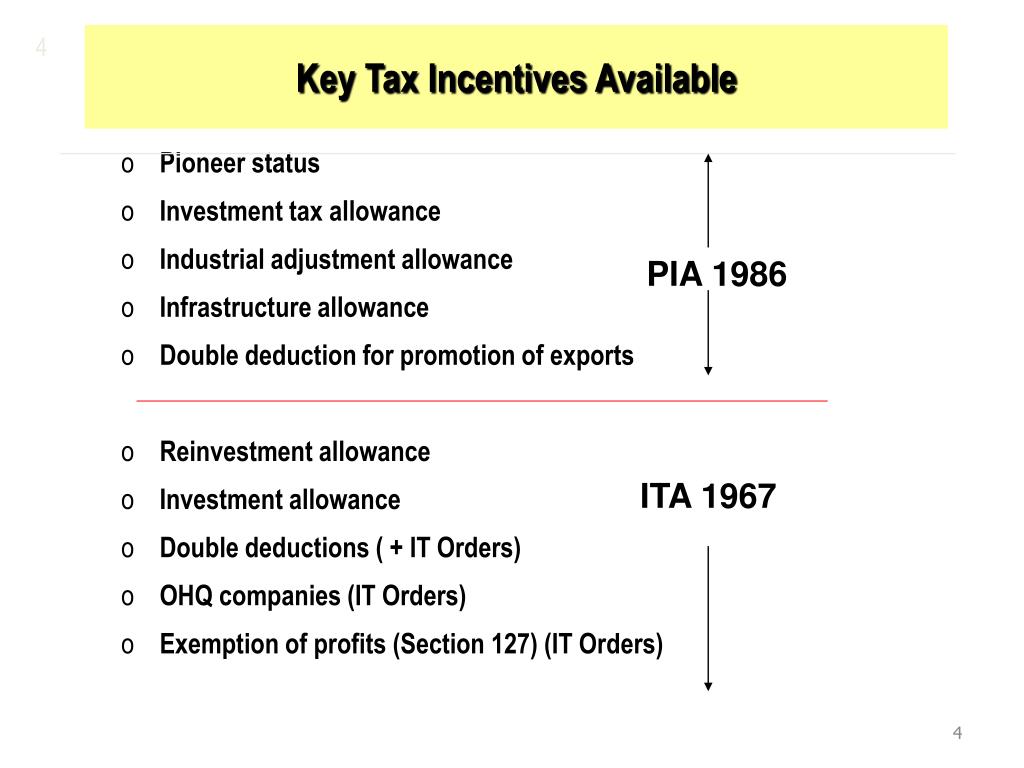

Pioneer Status is one of the incentives in the provisions of the Promotion of Investments Act 1986 which provides tax exemption partly or all on relevant business statutory income given to companies that participate in a promoted activity or of producing a promoted product in Malaysia. The Pioneer Status Incentive and Investment Tax. Eligibility for Pioneer Status and Investment Tax Allowance is based on certain priorities including the level of value-added technology used and industrial linkages.

Investment Tax Allowance ITA. Eligible activities and products are termed. The alternative to pioneer status incentive is usually the investment tax allowance ITA.

The determination of the selling price is a major policy decision for the firm and the cost accountant can make an important contribution to this decision making process by providing the management with costs which are relevant to the pricing decision at. The major tax incentives for companies investing in the manufacturing sector are the Pioneer Status and the Investment Tax Allowance.

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Www Mida Gov My Ica Ja Ik Ja Crd Amp Fp Guidelines And

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Acca Atx Mys Pioneer Status Part 2 Facebook

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Solved Justify Why Tax Incentives Especially Pioneer Status Chegg Com

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Do You Run Or Own A Green Penang Green Council Facebook

1 Incentives For The Aerospace Shipbuilding Shiprepairing Industries In Malaysia Malaysian Industrial Development Authority Ppt Download

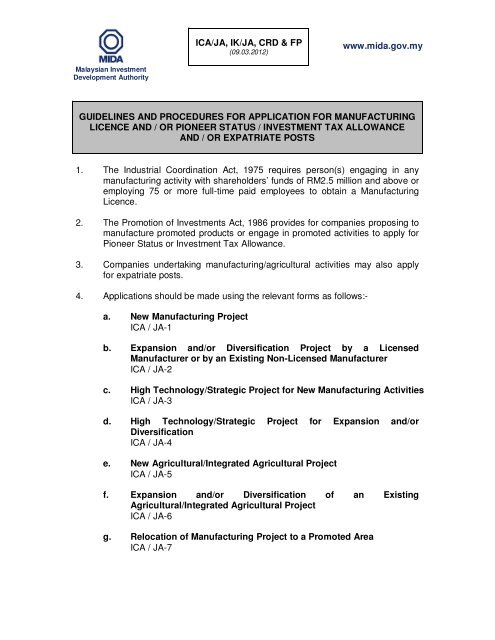

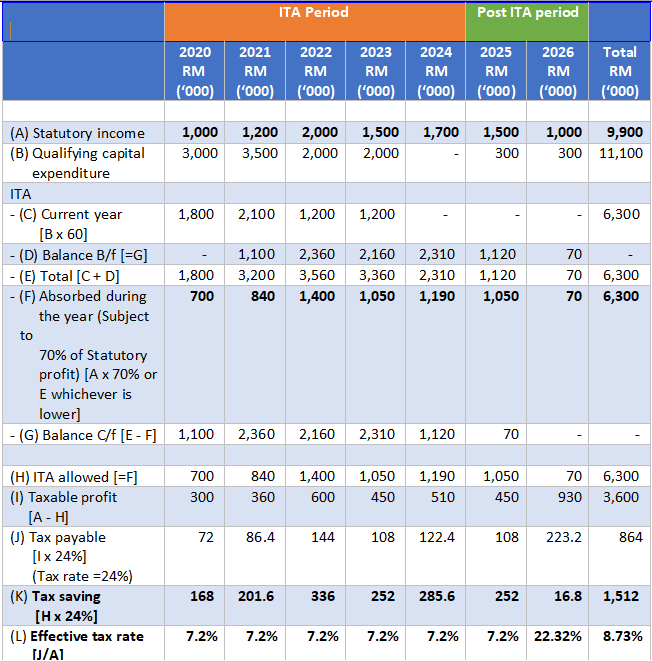

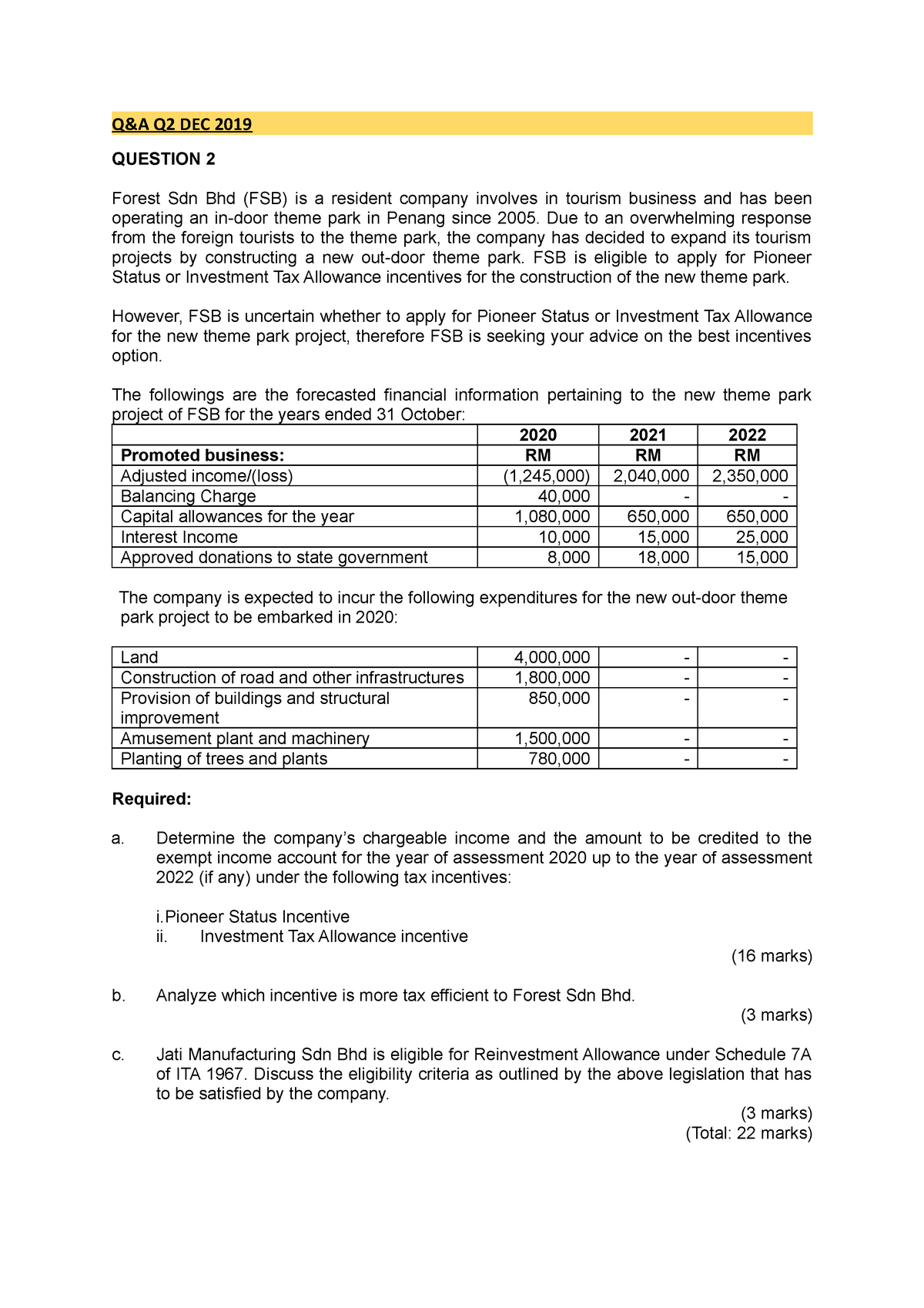

Q A Q2 Dec 2019 Q Amp A Q2 Dec 2019 Question 2 Forest Sdn Bhd Fsb Is A Resident Company Involves Studocu

Business And Investment Opportunities In The Machinery Equipment Supporting Engineering And Medical Devices Sectors In Malaysia Ppt Download

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Solved 7 The Mechanism Of Incentives 1 Point Under Pioneer Chegg Com

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Comments

Post a Comment